Past, Present, Future

Artificial Intelligence for Asset Management

"AI is like teenage $ex. Everyone talks about it. Nobody knows how to do it. But everyone thinks everyone else is doing it, so they claim they do it too."

Past, Present, Future

Artificial Intelligence for Asset Management

"AI is like teenage sex. Everyone talks about it. Nobody knows how to do it. But everyone thinks everyone else is doing it, so they claim they do it too."

Ways to go about Artificial Intelligence

Workshop/consulting project with an AI Leader

Boutique M&A or buy a stake in a company

Team liftout

Fund research or create partnership with a top AI university

Work with an AI Institute as a partner or investor

Hire AI leaders per project

Artificial Intelligence

CASE STUDIES

Silicon Valley AI Startups, and how they sell to firms like Amazon, Google and Walmart

Silicon Valley AI Startups, and how they sell to firms like Amazon, Google and Walmart

January 28, 2019 / Daniel Enskat

Venky Harinarayan and Anand Rajaraman first met at the Indian Institute of Technology, Madras and, while getting advanced computer science degrees at Stanford (and sharing an office with Sergey Brin), founded Junglee, a shopping search engine enabling customers to search for products from online and offline retailers in India, in 1996 (later bringing on two more co-founders). One of the first backers for the site was the Washington Post online, with a 12% stake.

Two years later, a young startup called Amazon acquired Junglee for $180 million, with Venky and Anand joining Amazon as General Manager and Director of Technology, respectively, working with Jeff Bezos for a while. Junglee.com was launched in India in 2012 as a comparison-shopping website.

They stayed for a couple of years, and then created Cambrian Ventures, backing a number of companies that Google acquired.

In 2005, next to Google in Mountain View, California, they created Kosmix. Kosmix started as a search engine, organizing the web into topic pages, with “a dashboard of relevant videos, photos, news, commentary, opinion, communities, and links” related to them. With the VC connections from Cambrian the duo had an easier time financing the company. In late 2005, Lightspeed Venture Partners gave $7 million, with $18 million in 2006 from Lightspeed and Accel Partners. By 2008, a fourth round of funding reached $20 million from Time Warner Investments, Accel, Lightspeed, DAG and Motorola CEO Ed Zander – even Jeff Bezos contributed, through Bezos Expeditions.

In April 2011, Walmart bought the company for about $300 million and turned it into @WalmartLabs, a tech research division for the company.

Anand also co-wrote a book, “mining of massive datasets”, with Stanford’s Jeffrey Ullman and Jure Leskovec. Jure now is the Chief Scientist for Pinterest, underscoring the small world of AI talent and that you have to know the right people to get the best talent.

As before, the duo stayed on for the transition, as SVPs for Global eCommerce, and then moved on with Rocketship Ventures, a $40 million Silicon Valley fund to back early stage companies.

@WalmartLabs, in the meantime, blossomed into a Silicon Valley research lab for Walmart to test emerging tech, with over 6,000 staff. And according to VentureBeat, the lab is adding 2,000 new full and part-time technologists, in California, Arkansas, Virginia and India.CTO Jeremy King in an interview with VB described optimizing the in-store selection of items ordered online to be picked up as “fascinating machine learning problems”. In order to compete with other tech companies and to appeal to Silicon Valley talent, Walmart pitches the technology positions as with “Walmart Labs” instead of just Walmart, and also emphasizes the scale of their global operations. King in the interview also mentioned creating initiatives like Tech Tuesday Meetups at the Bentonville headquarters for Walmart, with more to come. Walmart e.g. works with Bossa Nova Robotics in a pilot program in stores from Florida to California, to have the robots roam the aisles and scan the shelves to figure out what is in stock and what is selling. Bossa Nova is a Silicon Valley start-up that came out of Carnegie Mellon University, and thus far has raised $70 million for R&D, hiring and international expansion.

It’s a good blueprint for financial services or really any firms to get into big data, predictive analytics and AI, finding a great team with revenues in place, and plugging into them their larger infrastructure, to clean house and help with growth across all departments. And for the right price, it’s of course also a big win for the AI scientists, financially and scientifically.

You just have to know where to look.

From $2.5B to $58B… Two Sigma’s AI Investment Strategy: Humans and Big Data Crowdsourcing

From $2.5B to $58B… Two Sigma’s AI Investment Strategy: Humans and Big Data Crowdsourcing

December 30, 2018 / Daniel Enskat

Two Sigma describes itself as “a systematic investment manager, founded with the goal of applying cutting-edge technology to the data-rich world of finance.”

The SoHo, New York, based hedge fund was founded in 2001, by John Overdeck, David Siegel and Mark Pickard. Using AI, ML and distributed computing to invest, the fund has over $58 billion in AUM.

Overdeck, worth $5.5 billion, had good parental influences… his father was a senior mathematician at the NSA and his mother the director of the Computer Sciences Corporation. John went to Stanford, then on to Amazon and DE Shaw, before founding Two Sigma with David Siegel, former CTO at Tudor.

The firm has hired star researchers to the bench. For instance, this spring Two Sigma hired Mike Schuster, a 12 year senior research veteran on the Google Brain team, to head their AI expansion. He reports to CTO Alfred Spector, with whom he worked at Google, and the plan is to significantly expand the team.

Out of the company’s 1,300 people, over two thirds are involved in research and development.

Having the best in-house team is one thing – but Two Sigma goes way further. The website greets you with “SEEK: Calling all scientists, engineers, and academics. WE’RE HIRING”

And further still… as in crowdsourcing big data investment challenges.

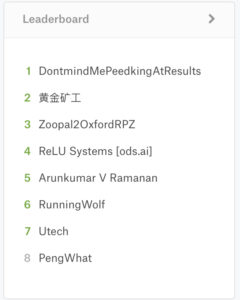

In 2017, the firm started running Kaggle data science competitions to code trading algorithms. It currently runs “Using News to Predict Stock Movements”, which with still nine days to go has already received 31,475 entries. The first prize for the comp is $25,000, then $20,000, $15,000, and $10,000 for places four through seven – AKA peanuts.

Kagglers, the data scientists on the platform, don’t build their algorithms for the money, they do it for the bragging rights. Importantly, Kaggle contests are won by people who are marginal to the domain of the challenge!!! In a few Hewlett-Packard AI competitions, none of the top three winners had any formal training in AI.

Which works out well for investment managers such as Two Sigma. The leader board for the challenge, as of today, is below:

The other two competitions run by Two Sigma on Kaggle, two years ago, involved financial modeling and rental listing inquiries.

Kaggle, the 8-year old online community of data scientists and machine learners, in turn, was acquired by Google in March 2017. Kaggle got its start by offering machine learning competitions and now also offers a public data platform, a cloud-based workbench for data science, and short form AI education.

When it comes to AI investing and the use of big data and machine learning to get an investment edge, Two Sigma grew from $2.5 billion to over $58 billion in ten years by focusing on human talent and big data crowdsourcing.

With the right team, you can, too.

JP Morgan and AI: „This is not Pie-in-the-Sky Stuff“

JP Morgan and AI: „This is not Pie-in-the-Sky Stuff“

January 30, 2019 / Daniel Enskat

JP Morgan has been extremely busy in the last few years following the tech giants’ blueprint for AI: hire the best people, make headlines, re-invent the business, and… make money in the process.

The firm’s public AI website, a part is shown below, highlights tech efforts around AI, FinTech, Blockchain, Development and Digital Payments.

40% of JP Morgan’s $10.8 billion annual technology budget is devoted to new efforts, including AI, robotic process automation and blockchain, and a big effort last year went into scooping up the best AI talent in the world.

Let’s start with some of the recent high-profile hires:

2018/2019: JP Morgan hired Apoorv Saxena, Google’s Head of Product Management for Cloud-Based AI, to become its Global Head of AI (Technology) for asset and wealth management. Apoorv within days of joining JP Morgan went on Twitter to announce that he is hiring engineers, scientists and AI experts and that they should reach out to him (his first hire in week one was Yang Wang as Executive Director for AI, from Facebook – Yang also worked with him on AI Frontiers).

JP Morgan then became the main sponsor of AI Frontiers (co-founded by Saxena) and early next month will hold the JP Morgan Silivon Valley AI Open Hiring Event, on February 5-7th, 2019. They will also move to a new office in Palo Alto with ambitions to have 1,000 engineers and AI experts there.

2019: JP Morgan hires Georgia Tech Professor Tucker Balch as Managing Director, AI Research, in Atlanta.

2018: JP Morgan in the summer hired Manuela Veloso, the head of the Machine Learning Department at Carnegie Mellon and a renowned AI Researcher, to become JP Morgan’s Head of AI Research, starting July 2018. She partners with the firm’s existing data analytics and quantitative research teams, and spearheads collaborations with universities and research institutions.

2018: JP Morgan brought on board Naren Chittar, Chief Data Officer for Salesforce, as Executive Director for AI on the west coast. Chittar sold his four-people team/company to Salesforce in 2015 and joined JP Morgan in November 2018.

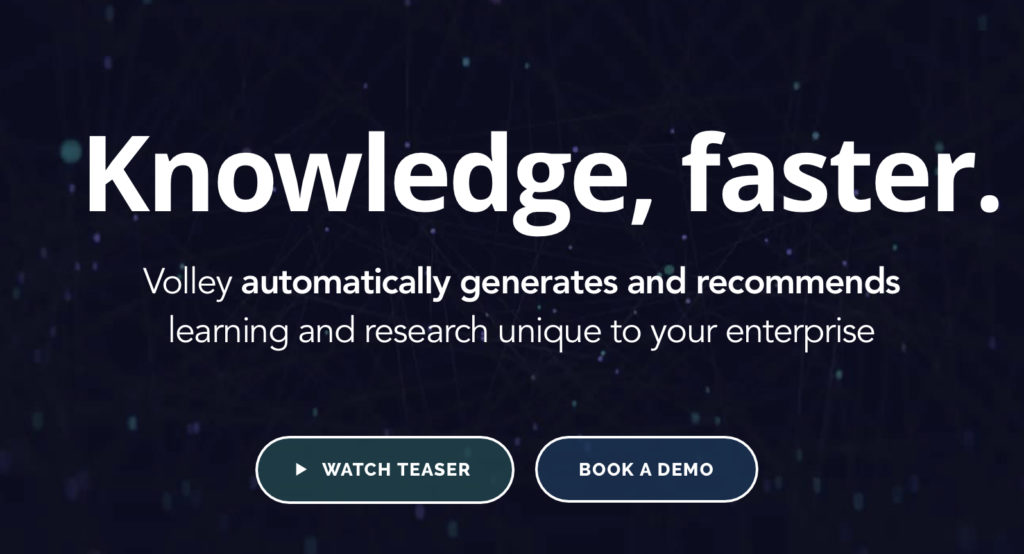

Late in the summer of July 2018, JP Morgan made a strategic investment in Volley.com, a San Fancisco based startup using AI to automatically generate training content for employees, e.g. for cybersecurity or compliance.

JP Morgan‘s Head of Learning Platforms, Joe Infozino, clearly was excited about the partnership, saying: „Volley’s innovative technology to ingest, integrate and target micro-learning content automatically can fundamentally transform the way firms like ours approach learning and knowledge management.“

A few weeks ago JP Morgan launched Finn by Chase, the firm’s all mobile bank, run by veteran JPM executive Melissa Feldsher.

2018: J.P. Morgan rolled out Amazon’s voice-activated assistant Alexa for investment banking clients to help them access research. Not long after the bank created mobile apps for its trading business, clients were using them for their own large trades.

And JP Morgan‘s treasury services division, which manages $5 trillion daily, is showing big corporate clients and their treasurers how an AI virtual assistant can handle question and anticipate their needs using deep ML. „Based on your behavior each time, it will start to learn what you ask for,” Jason Tiede, Innovation Head for Treasury Services said in an interview with CNBC. “We think there’s a huge opportunity to suggest creative and insightful recommendations to clients. When you log in, it can say, ‘Looks like you have sent 100 US dollar wires to Singapore. Do you know you could send a foreign-exchange ACH payment instead? Click here to sign up.

Back in the summer of 2017, JP Morgan implemented Contract Intelligence (COIN), a program that runs on a machine learning system able to cut down 360,000 billable legal hours down to a few seconds, while also reducing the error rate of loan-servicing mistakes. COIN was a first example of JP Morgan‘s focus on automation, along with new tools for front-line staff.

JP Morgan‘s COO/CTO at the time, Matt James (who left to become President at Cerberus), commented that „we‘re starting to see real fruits of our labor. This is not pie-in-the-sky stuff.“

At the same time, then Global Chief Information Officer Dana Deasy emphasized that this kind of automation is „freeing people to work on higher-value things, which is why this is such a terrific opportunity for the firm.“

Dana moved on since then as well, and is now the US DOD Chief Information Officer, as the Department of Defense is preparing a 10 year, $10 Billion move to the cloud – JP Morgan is in good company with its AI focus.

BlackRock to Partner with Microsoft on Digital/Retirement; with Acorns on Next Gen Investors

BlackRock to Partner with Microsoft on Digital/Retirement; with Acorns on Next Gen Investors

December 14, 2018 / Daniel Enskat

We use technology to think beyond what’s possible …. is how BlackRock, the largest investment manager in the world with $6.4 trillion in AUM, welcomes visitors to it’s homepage.

This week BlackRock and Microsoft announced a partnership to create a retirement solution investment platform with digital financial planning tools, alongside a new generation of BlackRock products that offer guaranteed retirement income.

Not entirely surprising, given that BlackRock is one of the largest stakeholders in Microsoft (as well as Facebook, Apple, and HP) and that it added Microsoft’s Peggy Johnson, EVP for stategic partnerships, to its board earlier in the year.

Peggy oversees investments through Microsoft’s VC fund, M12, which operates out of the US, Europe and Israel – and prior to this role spent 24 years at Qualcomm, including on the EC. All of this points to artificial intelligence, technology-enabled app-based retirement investing, and more.

According to the WSJ, BlackRock is planning to bundle digital and asset-management offerings through the platform, which is slated to be released in 2019.

Larry Fink and Satya Nadella commented on the partnership, in what is just the beginning of what will likely be more investment management + technology partnerships.

The move comes after BlackRock in May 2018 became an anchor investor in Acorns, the micro-investing app with almost 3.5 million accounts, back then announcing a partnership focused on improving the savings and investing behaviors of the next generation of investors. COO Rob Goldstein commented on the partnership with “Acorns is a pioneer in creating innovative ways to engage investors in a mobile-first world. By deepening our understanding of how their customers use investment technologies, we can apply those learnings across BlackRock to evolve the products we build for our distribution partners.”

Manuela Veloso, Head of AI for BlackRock as of 2018, reports into Goldstein.

Last but not least, last month BlackRock also entered into a strategic partnership with Envestnet to enhance the financial advisor experience on the digital and wealth sides.

Much more to come, sooner than later.

Morgan Stanley hires

AI/Digital Execs,

announces AI/tech partnerships for financial advisors

Morgan Stanley hires AI/Digital Execs, announces AI/tech partnerships for FAs

December 19, 2018 / Daniel Enskat

Since Jim Gorman became CEO of Morgan Stanley, his key initiative has been around technology, and, more recently, artificial intelligence, spending $4 billion on trading/fixed income, financial advisory, wealth management, et al.

2018 has been a breakthrough year on various fronts:

– In June 2018, Morgan Stanley hired Michael Kearns as Head of AI, an expert on AI since the 1980s, when he wrote his Harvard PhD on the complexity on machine learning, before spending ten years at AT&T Labs, and advising firms including SAC Capital, Lehman Brothers, and others. He also is a long-time Professor of Computer Science at the University of Pennsylvania.

– MS spent years on developing the AI “next best action” tool for its 16K financial advisors, combining ML, predictive analytics and workflow technology. As part of that effort, the firm in 2016 hired Naureen Hassan as Chief Digital Officer (from Schwab), and Jeff McMillan as Chief Data and Analytics Officer. Next best action combines structured and unstructured data for investment ideas to be shared with clients: AI goes through research reports (55,000 per year produced by MS), market data, client databases, etc to come up with insights and draft recommendations. It also looks at clients’ life events, deadlines, birthdays, service alerts, elder care etc to draft customized actions for advisors.

– In November 2018, Morgan Stanley announced that launch of WealthDesk, a new digital platform that the 16K advisors will be trained on now and in 2019. WealthDesk is aiming to provide them with one consolidated dashboard to go to for all financial planning, advice and implementation tasks. It was tested by selected FAs and now is being rolled out broadly.

– In December 2018, Morgan Stanely announced a technology partnership with Yext and their AI ready data structure to provide Morgan Stanley Financial Advisors with a platform to create and manage their business websites and digital presence (and leverage Yext’s intelligent search capabilities to enhance prospecting).

“AI-powered services have transformed the way people search for financial services, making it vital for Financial Advisors to provide direct answers everywhere consumers are looking,” said Howard Lerman, Founder and CEO of Yext. “We’re proud to put Morgan Stanley Financial Advisors in control of the facts about them online, so that they can easily help provide accurate answers to complex consumer questions and win more business.”

In support of its larger tech and AI strategy, Morgan Stanley has Fintech partnerships with BlackRock/Aladdin, Hearsay, Investnet, Salesforce, Solium, Twilio, and Yodlee among others.

Not yet WeChat as a SuperApp for financial advice, but it’s a start.

SEB Head of Emerging Tech becomes Group CIO after receiving Supernova award for Aida AI

SEB Head of Emerging Tech becomes Group CIO after receiving Supernova award for Aida AI

January 5, 2019 / Daniel Enskat

Nicholas Moch joined SEB in 2008 as Head of IT Governance and four years later took over Information, Strategy, Architecture, and Emerging Technologies at the Nordic Financial Services Group.

About a year ago, he was handed a “Supernova Award” in Silicon Valley for the way SEB uses AI in its digital interactions with customers, and the innovative use of emerging tech.

SEB had created Aida, above, an AI Assistant for internal IT assistance and external chats. Aida is based on AI platform Amelia, developed by IPSoft. IPSoft has a case study on the development and the deployment of Aida for SEB on its website.

Aside from the prize for SEB and Moch, employees and customers seem happy:

“We see this as an exploratory journey in which we start with small, narrowly-defined application areas,” comments Nicolas Moch. “The main purpose of this venture is to create an entirely new channel in which customers can get answers to their questions as quickly and efficiently as possible at times that suit them.”

It definitely worked for Moch – last month SEB made him Group Chief Information Officer – thanks, Aida.

How To Become (Remain) Asset Management CEO? Artificial Intelligence

How To Become (Remain) Asset Management CEO? Artificial Intelligence

January 7, 2019 / Daniel Enskat

A focus on technology and research with an eye on AI is a good way to become CEO of a large European asset manager.

Santander Asset Management in February 2018 appointed Mariano Belinky as new CEO.

Belinky until February was the Managing Partner of Santander InnoVentures, which the bank set up in London as a $100 million fund in July 2014 to get closer to the wave of disruptive innovation in the FinTech space. The aim is to support the digital revolution to ensure clients around the world benefit from the latest know-how and innovations across the Banking Group’s geographies. The fund is part of Santander Group’s broader innovation agenda, in which the company helps FinTech companies grow from a very early to a more mature stage.

In 2017, InnoVentures invested in AI startups Personetics Technologies (creates “chatbots” for customer service questions – offices in NY, London and Tel Aviv) and Gridspace (creates technology banks can use to monitor call center conversations – headquartered in San Francisco).

The AI focus at InnoVentures, along with prior experiences at McKinsey (associate principal), Columbia Business School (Research Associate) and Bridgewater (research technology associate), landed Belinky the CEO role in an environment where AI and big data are becoming ever more important for banks and asset managers.

Good news:

– for CEOs with AI interests and teams around them that make use of AI for growth

– EC members with AI experience or projects that help them grow AI & their roles

– AI experts with aspirations to assist CEOs or become CEOs

Let the games begin.

How does the US Army deal with AI? RCO, AFC, AI Signals and PE firms

How does the US Army deal with AI? RCO, AFC, AI Signals and PE firms

December 7, 2018 / Daniel Enskat

How does the US army deal with Artificial Intelligence?

Two years ago it set up the “Rapid Capabilities Office”, RCO, to deal with emerging technologies and to focus on top modernization priorities, especially AI.

As of November 2018, the RCO is led by COL John Eggert as the acting Executive Director. Eggert enlisted in the US Army as a nuclear, chemical, and biological specialist in 1984.

The RCO recently created the Army Signal Classification Challenge, posted on Challenge.gov and FBO.gov, challenging industry to create the best-performing algorithm for accolades and prize money. The challenge focused on using AI and ML to speed up the rate at which EWOs could sift through noise that comes with signal detection.

“The response was overwhelming,” according to Rob Monto, director of the RCO’s Emerging Technologies Office. “We had more than 150 participants from across traditional and nontraditional industry partners, universities, labs and government. As an incentive, we offered $150,000 in prize money.”

The winners came from a federally funded R&D center, an independent group of Ozzie scientists, and a team from big business. The RCO announced winners on Aug. 27, 2018.

First place and $100,000 went to Team Platypus from The Aerospace Corp., a national nonprofit corporation that operates a federally funded research and development center.

Second place, with an award of $30,000, went to TeamAU, made up of a small team of independent Australian data scientists.

And third place, with a prize of $20,000, went to THUNDERINGPANDA of Motorola Solutions.

It’s one way how financial services firms can approach their AI strategies.

The army in July 2018 set up another center to “forge the future”, the Army Futures Command, in Austin, TX, under the leadership of four-star GEN John Murray. AFC is focused on readiness for future combat. PS… as their investment team lead, the army hired the Managing Partner of a San Francisco tech-focused private equity firm.

More details and the case study can be found on our client portal.

AQR Turning 20 and Showing an Open-Source Team Approach to Use Data Science and AI in Asset Management

AQR Turning 20 and Showing an Open-Source Team Approach to Use Data Science and AI in Asset Management

January 7, 2019 / Daniel Enskat

About ten years ago I interviewed Cliff Asness at an Institutional Investor event – as with his investment and research philosophy, it was honest and provocative. AQR went from $12 billion to $225 billion in a decade and a half, used data science and open source research from day one and has pioneered a number of investment concepts and AI/ML in asset management,successfully.

In short, a good case study for us to examine a few key concepts around AI and data science, but let’s start from the beginning:

Twenty years ago, a team of researchers that met during their PhD work at the University of Chicago left Goldman Sachs’ quant group to set up AQR, putting the QUANT front and center.

Working mostly with institutional investors, they decided to share their research and investment process in-depth from day one, including publishing it in academic journals – no black boxes.

Risky, but it worked.

With a focus on diversification, factor investing and alternative investment (uhm, AI) strategies, AQR jumped into risk parity, managed futures, liquid alts and other concepts early on. They added academics and high-level researchers to their bench, with 84 PhDs among their 1000+ employees.

Focusing on the effective use of data science, AI and ML to help with investments, AQR:

– three months ago hired a Head of ML, along with his team and a $13 billion book of business from Guggenheim.

– opened a Tokyo office and an engineering center in Bangalore, India in 2018.

– started the QUANTA academy, a learning and development center for employees and clients (tech skills, leadership/management and personal enrichment).

– hand out the AQR Insight Award ($100k) for important research endeavors. A bit similar to Two Sigma’s big data competitionswe wrote about recently.

– started the AQR Asset Management Institute in partnership with the London School of Economics (LSE, grants/prizes)

– sponsors the AQR Top Finance Graduate Award at Copenhagen Business Schoool

– offers datasets to download on their website (betting against beta, commodities for the long run, credit risk premium, et al).

– have “the curious investors” podcast (recent episodes include an active/passive discussion between Cliff Asness and John Bogle, and one on “the rise of the machines”, with John Liew on the early days of quant, and AQR’s CTO).

– Cliff’s perspectives: “Sometimes we just want to make a point, or start a conversation. These timely posts offer opinions about everything from quantitative finance to baseball stats.”

– And, of course, for the 20th anniversary: 20 for 20, a collection of AQR’s most influential research papers, 14 of which written by Cliff Asness. Very unlike Ray Dalio’s principles, yet also very similar.

Credit Suisse Data Science Team Leaves to Set up AI Shop, sees Google and Alibaba as the New Competition

Credit Suisse Data Science Team Leaves to Set up AI Shop, sees Google and Alibaba as the New Competition

February 4, 2019 / Daniel Enskat

About a year and a half ago, Jonathan Wilmot, Credit Suisse’s Chief Global Strategist and Head of Macro Research after over 30 years with the firm, took the data science department and started his own AI investment boutique, WilmotML – as in Machine Learning.

Aric Whitewood, CS’s Head of Data Science for seven years, left as well, along with his small core team of machine learning specialists. Whitewood got his PhD at UCL in Electronic Engineering and before Credit Suisse was in Thales Aerospace’s Systems Research Group.

In addition to the existing core team the duo also added a COO from KPMG and the LSE.

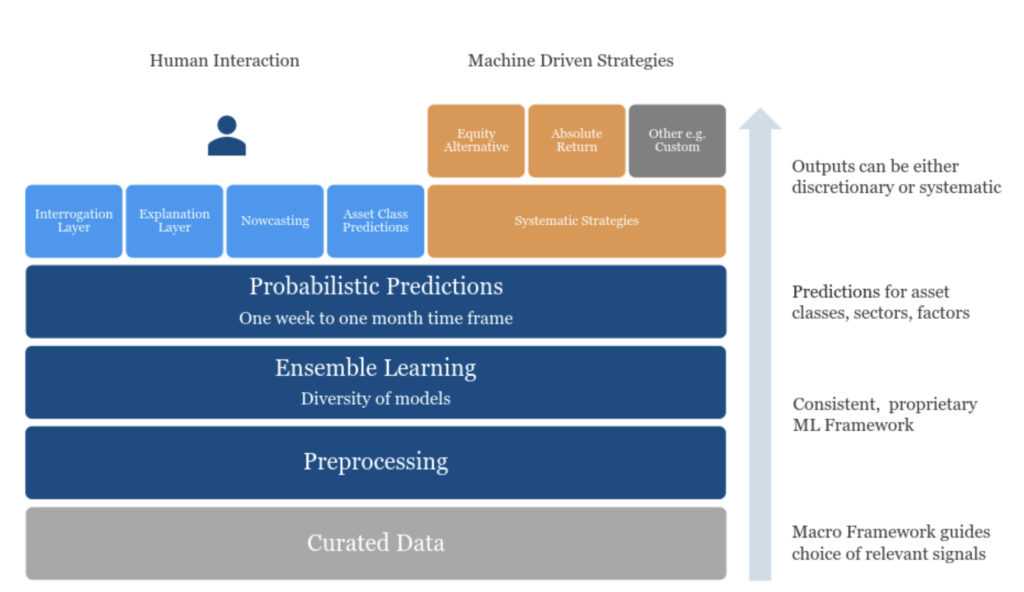

The pitch is simple: the best global macro research paired with advanced machine learning produces better investment results. The AI part of the equation focuses on

- noisy data

- curated data

- non-stationarity

- proprietary models

- small data sets

- transparency

To create a Global AI Allocator, aka, GAIA. GAIA is proprietary platform that creates predictions for asset classes, factors and currencies globally, implemented with highly liquid ETFs.

Some of the Secular Themes for WilmotML include: AI Everywhere, New Energy and Transport, Connected Cities, Smart Healthcare, and Geo-Political Reset.

Importantly, Wilmot recently said that the new competition will be Google, Alibaba and Tencent, i.e. the tech giants as the new fund managers in the upcoming AI machine age.

Exciting times.

Tech-focused Real Estate startup hires Microsoft AI head as CTO

Tech-focused Real Estate startup hires Microsoft AI head as CTO

December 4, 2018 / Daniel Enskat

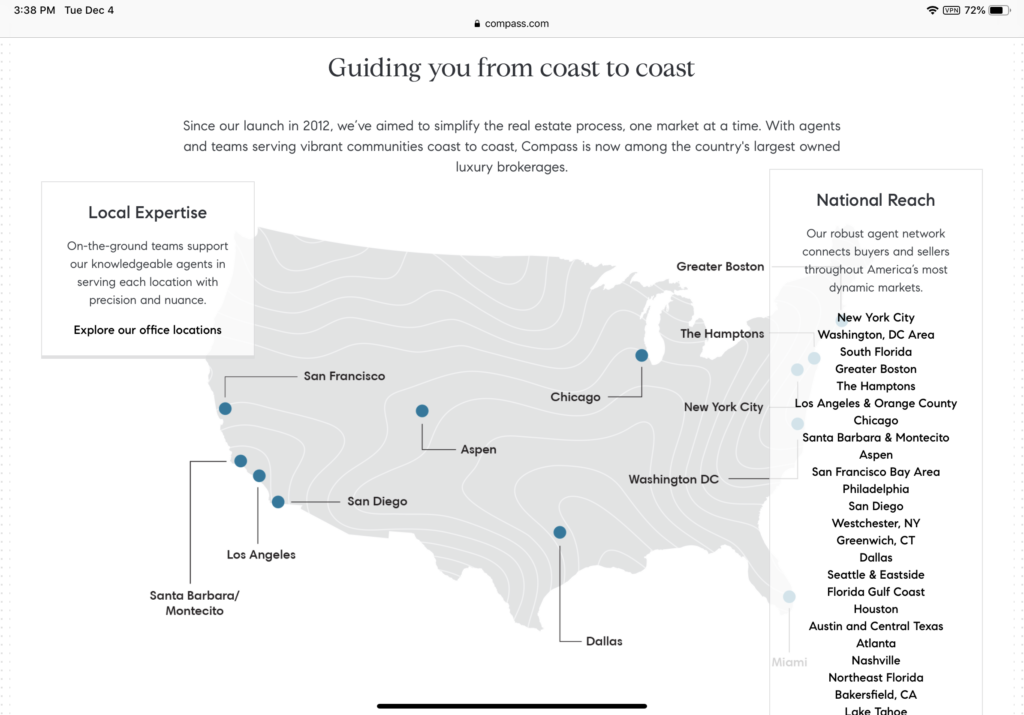

Compass, a tech-focused real estate platform, just hired Microsoft’s chief tech and artificial intelligence leader Joseph Sirosh as new CTO, reporting into its COO. Sirosh will lead the engineering team to develop new AI-powered products for the entire real estate ecosystem and the 7000+ Compass agents.

Compass is a unique beast: it was founded in 2012 by Ori Allon, an ex-Twitter and ex-Google computer science PhD, Robert Reffkin, who previously worked at McKinsey and Goldman, and Ugo di Girolamo, an engineer with Twitter and GE Homeland Security – with their main office on 90 Fifth Ave in NY, near where I have been living for 20 years, with the NYU energy all around Washington Square Park.

The team as well stands out… COO Maelle Gavet prior handled Priceline’s global operations, and CFO Kristen Ankerbrandt spent 12 years at Carlyle. Head of Product Eytan Seidman was at Microsoft and TripAdvisor, and the CMO Khurrum Malik at Spotify.

Nobody ever worked in real estate before, yet their company has become a leader in the US luxury market in about five years, with the promise of AI for much greater growth going forward.

So why would one of the premier AI leaders, working at the most valuable company in the world in tech and AI, Microsoft, leave that position to work for a NY real estate startup?

“I’m excited to join Compass to transform the real estate experience through technology,” said Sirosh. “Compass is a company with a once in a lifetime opportunity and when technologies like Artificial Intelligence are used to enhance the human experience, it can be a game changer. It will be a privilege leading this organization’s impressive technical team towards this new future,” according to PR Newswire.

Enough said.

Also, it is well funded and big names stand behind that AI promise: the group just closed $400 million in Series F.

Investors in Compass highlighted on its website include Softbank, Fidelity, Wellington, Goldman Sachs, Kenneth Chenault / American Express, Marc Benioff / Salesforce, and others.

Overall, Compass has raised $1.2 billion from investors, with $400 million from SoftBank and QIA in the fall – Real Deal values Compass at $4.4 billion.

Manulife/John Hancock and their “LOFTy” AI Ambitions –

now in Silicon Valley

Manulife/John Hancock and their “LOFTy” AI Ambitions – now in Silicon Valley

January 13, 2019 / Daniel Enskat

Canada has always been a (quiet) leader of AI in its own right, with MILA, CIFAR, et al.

Manulife in Toronto owns John Hancock in Boston (combined AUM C$1 trillion+) and they have been playing with AI for insurance and investment management in a variety of ways.

Manulife – and under its John Hancock brand in the US – has established a global network of LOFTs in Boston, Toronto and Singapore, starting with a team liftout in 2016.

LOFT = Lab of Forward Thinking.

LOFT, an “internal incubator”, provides a digital platform for employees to collaborate and devise new technological solutions for the firm’s wealth, asset management, and insurance customers.

Two years ago Manulife’s LOFT started working with Boston-based AI startup indico data solutions, to create deep learning data tools to help analysts go through reading materials and financial information faster.

LOFT has been using indico’s platform to develop an artificial intelligence (AI) and Deep Learning tool to analyze unstructured financial data – the goal being to use DL to analyze data from news articles, analyst reports and other similar sources and present recommendations that could help investment researchers and portfolio managers make more informed decisions faster than before.

“indico helps us accelerate our use of Deep Learning to improve the decision-making capabilities of our analysts, portfolio managers and researchers,” commented EVP and CIO Greg Framke. The announcement followed Manulife LOFT’s collaboration with Nervana Systems to build the next generation of intelligent applications (Nervana, of course, was founded by a former Qualcomm exec with CIA funding, and then bought by Intel for $408 million last year, as we discussed recently in detail).

But let’s keep going.

John Hancock around the same time also bought San Francisco-based Guide Financial, a firm that applies “artificial intelligence to help investors make better planning decisions and build wealth.” Partnering with Inuit, Guide touches 19,000 financial institutions to aggregate a client’s accounts and financial information into a digital portal, where a FP engine analyzes the information and an algorithm helps advisors with cash flow and investment decisions. Advisors can message clients directly through the portal and set Guide Financial push notifications to keep clients informed and on track.

So far so good.

Guide’s Co-Founder and CEO, Uri Pomerantz, went on to create Twine John Hancock with and for the company, and last month was named the MD and Head of John Hancock Ventures in Silicon Valley.

Below is a podcast with Uri on how he used new technologies, Instagram et al to build his business and sell it to John Hancock.

For the full case study on the LOFT and Venture talent and the AI techniques and technologies involved, including the team liftout that started the whole process, register below.

Google Maps AR Mode – Welcome to the AI Future

Google Maps AR Mode – Welcome to the AI Future

February 13, 2019 / Daniel Enskat

After introducing an augmented reality mode for maps last year at I/O 2018, the WSJ got early access as Google is rolling it out to a limited number of users. As the WSJ reported today, when you start AR mode, the GPS matches your location with the vast amount of street view data collected by Google over the last ten years. Looking for a coffee shop, “it was as if Maps had drawn my directions onto the real world, though nobody else could see them.”

The implications are huge. First, in countries such as China, with less focus on data protection and ambitions to rule AI globally, the technology could match facial recognition with information about the people near you, including names, social media accounts, and more (especially if you’re the government).

Pair that with Microsoft’s Holoportation and Bose’s new audio glasses without an actual headphone and Minority Report becomes old news.

This also has huge implications for shopping, lifestyle, investing and more. E.g. I walk past a backpack or car I scan, and I can Amazon Prime it for later that day (delivered by Scout, the R2D2-esque AI robot currently being tested in Snohomish County, WA).

Most businesses will be late to the party, if not waking up with a massive headache once they realize what they are late to. As the AI investment boutique that recently spun out of the data science department at Credit Suisse said, the competition for them going forward is likely to be Alibaba and Amazon, not other Swiss or global asset managers.

Foot Locker’s Pivot to Data Science and AI

Foot Locker’s Pivot to Data Science and AI

February 25, 2019 / Daniel Enskat

When a traditional shoe-retailer like Foot Locker creates data-science teams and completely revamps its corporate culture and process around their (young-ish) client base, with initiatives executed across product, user X, design and engineering by the Chief Information and Customer Connectivity Officer, it becomes clear how much AI is changing even the most “sleepy” industries.

A few years ago Footlocker hired an EVP level position, Global Chief Information and Technology Officer, to help create a culture of large scale data mining and predictive analytics to help Foot Locker connect in new and deeper ways with its customers. Pawan Verma came from Target, where he led digital technology and API Platforms, but really cut his teeth at Verizon for over a decade, as IT Leader and Senior Director for Data Architecture and Product Engineering.

A key element of the cultural shift was to vastly increase the tech staff for Foot Locker. A typical job ad today, taken form a posting for Bradenton, Florida, reads:

Seeking a Data Scientist to lead the team in developing sophisticated predictive models, mining large data sets for insights, building scalable data products, and growing the overall Data Science capability at Foot Locker

The ideal candidate possesses the following qualifications.

- Advanced SQL skills and is comfortable operating with relational data models and structure.

- Advanced skills with NoSQL databases and can interact with large amounts of data stored in a Hadoop environment.

- Is capable of accessing data via a variety of API/RESTful services.

- Advanced programming skills in either R, Python, or similar analytical language.

- Intermediate knowledge of Linux and Bash. Can interact with the OS at the command line and create shell scripts to automate workflows.

- Experience with state of the art techniques such as AI and Deep Learning.

- Advanced knowledge of Apache Spark.

- Intermediate knowledge of cloud environments such as AWS and Azure.

- Intermediate understanding of software development and collaboration, including experience with tools such as Git.

- Exceptional written and verbal communication skills, comfortable presenting in front of large audiences.

- Excellent data visualization skills, is able to determine the appropriate visualization for a variety of data types and create compelling stories with data.

- An advanced understanding of supervised and unsupervised learning techniques including; variable selection, feature engineering, model generation, model diagnostics, and deployment.

- Excellent statistical skills that are grounded in a thorough understanding of testing and frequentist/Bayesian methodologies.

EDUCATION and/or EXPERIENCE

Bachelors Degree, Masters Degree or PhD. in a Data Science, Applied Mathematics, Computer Science or otherwise research-based field; 3-5 years of related experience and/or training; or equivalent combination of education and experienc

Footlocker used to do 4-5 tech releases per year – now they sometimes do 4-5 per day.

Data science, machine learning and artificial intelligence will change and already are changing every industry worldwide, from the bottom up, with individuals experiencing a personal change in their use of technology, and then expecting this change to extend also to their businesses and purchasing decisions.

Start small or start big, but start now.

Brevan Howard Appoints Head of AI Driven Systematic Investments

Brevan Howard Appoints Head of AI Driven Systematic Investments

January 23, 2019 / Daniel Enskat

Brevan Howard, after hiring Karim-Patrick Khiar in the spring of 2017 as Head Data Strategist, two months ago made him the Head of AI Driven Systematic Investments… this marks an increasing push by (Alternative) Asset Managers to implement AI in the investment process, once big data is organized effectively.

BH, founded in 2002, is one of the leading global macro absolute return hedge fund managers. The group has 200+ employees with offices in London, New York, Geneva, Jersey, Hong Kong, Washington and Singapore.

Of course, this can also backfire, as it did for Credit Suisse when the team to do just that decided to walk out and start a boutique AI investment shop. Either way, asset managers need to prepare themselves, strategically, and tactically.

Amazon R2D2-esque AI Bot, Scout, Starting Deliveries in Washington

Amazon R2D2-esque AI Bot, Scout, Starting Deliveries in Washington

January 24, 2019 / Daniel Enskat

Meet Scout, the little R2D2esque AI box on wheels that is now making deliveries in Snohomish County, Washington, for Amazon. It will have a human with it in the beginning as the system is tested, but then Scout is on its own. Soon in a neighborhood near you, thanks to AI.

Countries and the fight for AI supremacy

US & Canada

- DARPA/AFC/SRI/Xerox Parc

- FAANG

- 100-Year-Study on AI / AI Index

- MILA / CIFAR / Vector Institute

Israel

Israeli Defense Force

Unit 8200

Government of Israel

Waze / Startup Nation

Technion Israel Institute of Technology

China

- New Generation AI Development Plan

- BATX

- Robotics Industry Development Plan

- Artificial Intelligence 2.0

Europe & UK

European Union AI Project

Silicon Fen

Cyber Valley

Max Planck Institute for Intelligent Systems

IDSIA

Artificial Intelligence in Asset Management

Hiring and M&A Activity

Uber lifts out team of 50 from Carnegie Mellon

Facebook takes NYU and IBM Big Data Lab teams for FAIR

Fidelity Labs/TedX Boston / NVIDIA supercomputer

Samsung opens US/Canada/UK/Russia AI labs with new teams

Poaches Andrew Blake from MS Cambridge and Larry Heck from Google, among many others, with a targeted headcount of 1,000 AI researchers by 2020

Microsoft has ‘Holoportation’ to holoport families and coworkers

Accenture buys Intrigo Systems (digital supply chain), MindTribe, PillarTechnolgoy, Certus Solutions (oracle cloud caps), Clearhead (personalize digital tools)

Headspace buys Alpine.ai (voice apps)

PayPal buys Jetlore (predictive AI retail)

Baidu buys Kitt.AI

Citadel hires Microsoft Chief AI Scientist

Li Deng joined Microsoft 17 years ago out of academia, and now will build the AI opportunities for the hedge fund in Seattle, NY and Chicago; Deng authored six technical books on deep learning, speech processing, discriminative ML and NLP. Same as DE Shaw/Pedro Domingos; Morgan Stanley/Michael Kearns

Facebook hires JP Morgan Head of ML

Bloomberg hires Google leader as head of Data Science

RenTech lifts out IBM Team

$28b IBM pension plan; Mercer/Brown; “what do computational linguists know about running money?”; team of 9 left

Blackrock sets up Palo Alto AI Lab, Tech 2020

Man hires ML head with a focus on ‘Quantamental’, consults with Duke

Bridgewater takes IBM Watson head to lead ‘Systemized Intelligence Lab’

JPM creates COIN to save 360,000 billable legal hours

Samsung buys Zhilabs (5G real-time intelligence network)

Compass RE startup hires Microsoft AI Head as CTO

Joseph Sirosh is new CTO to lead the engineering team for AI-powered products; founded in 2012, Compass has $4.4 billion valuation, with $400m from Softbank and QIA last quarter; Founders Ori Allon (Twitter/Google); Robert Reffkin (McKinsey/GS); Ugo di Girolamo (Twitter/GE Homeland Security); COO Priceline; CFO Carlyle; CMO Spotify; nobody with real estate experience

Facebook buys Team Ozlo, Bloomsbury AI

AQR hires Facebook AI Head

Cognizant hires 30-year IBM veteran as Head of AI

Barclays hires Chief data scientist from BuzzFeed

Millennium hires Head of Data Science from Point 72

Amazon takes academic team to lead Cambridge effort

JPM takes AI leaders from Carnegie, Google,

Cerberus creates CAIO role, takes from JPM/GS

State Street creates ML/NLP Quantextual Idea Lab, Project Beacon

Point72 lifts out CIA AI team, creates P72.vc

Matt Granade from Bridgewater; In-Q-Tel/CIA VC fund team liftout for Palo Alto AI lab (Daniel Gwak/Sri Chandrasekar); early stage big data/ML companies; AI investing as a new asset class

BioNyfiken, embeds RFID chips into workers, Chief Disruption Officer

Intel buys Vertex.ai (plaidML open source project)

Moneyfarm buys Ernest (personal finance chat bot)

Verizon buys Niddel (ML threat detection)

Manulife in AI partnership with University of Waterloo

Millennium hires Head of Data Science from Point 72

Credit Suisse looses Head of Data Science & team (set up AI company)

Johnathan Wilmot (30 year CS veteran, head of macro investing) and Aric Whitewood (Head of Data Science) and his team left CS to set up WilmotML, with the promise to use AI and macro risk awareness for advisory and investment products

ThirdPoint takes WorldQuant PM as Chief Data Scientist, with $2m pay

Bezos gives $2m to fund UW ML professorships

Apple buys Siri from Stanford Research Institute

SRI International 2007 spin-out (1 of 66); tech (sophisticated ML including convolutional neural networks and long-short-term memory) was created by Nuance with SRI/Lausanne University JV prototype, Didier Guzzoni’s PhD thesis; joined as chief scientist for Siri when Apple bought it in 2010 and released it in 2011

Morgan Stanley hires UPenn/SAC/Bell Labs has Head of AI

Dubai tests Volocopters (former Daimler team), 25% traffic by 2030

LinkedIn buys Glint (employment engagement system)

Microsoft buys GitHub ($7.5b, dev platform), Bonsai (AI startup), Semantic Machines,

Qualcomm buys Scyfer

BATX in China backs 50% of AI startups

Baidu (AI), Alibaba (Didi former Alibaba exec), Tencent (WeChat 1 b users), Xiaomi (IoT, smart homes/wearables); $1T+ market cap, 1,000 new ventures funded in last decade, 50% average annual growth;

NN Investment Partners hires Head of Automated Intelligence Investing

MILA hires chief talent officer from Cirque de Soleil as CEO

S&P takes Reuters exec to become Head of AI and Data Science

Target hires Principal AI Scientist (ex Baidu, Google, Carnegie Mellon)

Baillie Gifford gives $5m to fund Uni of Edinburgh AI ethics chair

Baillie Gifford gives $5m to fund Uni of Edinburgh AI ethics chair

Goldman takes Amazon AI leader, starts Data as a Client Service

WinSun 3D prints 10 houses in 10 hours, including a 12,000 sf mansion

NVIDIA starts “I am AI” campaign

Google buys Onward (advanced chat bots), AImatter (photo AI),

Amazon buys Pillback ($1b, online pharmacy), Game Sparks, Ring ($1b, smart doorbells), Blink (camera chips), Sqrrl (advanced threat detection), Blink, Whole Foods, BodyLabs, Harvest.ai (cloud security), GraphIQ, Souq (UAE eCommerce),

Two Sigma hires Harvard Neuroscientist as Chief of Staff

HSBC hires global CTO from GoDaddy

Two Sigma hires Google Brain Lead

Nordea creates AI credit team

Intel buys Nervana for AI chips (ex-Qualcomm, CIA funded)

$408m for 48 people startup; lead by Qualcomm Researcher Naveen Rao with $25m from In-Q-Tel in venture funding and contracts; access to tech with Intel deal

Key Takeaways

Start Small or Start Big but Start NOW

Find the Best People to Own and Lead YOUR AI

Create a Daily AI Routine for You and Your Teams

-

0%of asset management companies have not sufficiently integrated Artificial Intelligence into their business.